Yarab A |Updated on: June 28, 2022

It is quite common that businesses have a distributed system of manufacturing units or service rendering units across the nation. In simple words, businesses with Head Offices (HO) and Branch Offices (BO) which are spread across the nation - could be in the same state or a different state. Under this system, in order to have better operational efficiency and control, usually businesses adopt centralized billing for procurement of common services at the HO. This situation leads to the accumulation of input tax credit paid on common inward supplies which are used by the branch units.

In order to avoid the aforesaid situation, the concept of Input Service Distributor (ISD) was introduced in CENVAT credit rules, which allows the HO to distribute the input tax credit to eligible units which are engaged in manufacturing or rendering of taxable services. The HO, which does the centralized billing for procurement of common services is termed as the ‘Input Service Distributor’.

In order to distribute the credit, the HO has to obtain a separate registration as an ISD, and file half yearly return.

As an ISD, the HO mainly performs the following:

- Receives service tax invoice for availing common input services

- Distributes the input tax credit to eligible units by issuing an invoice/challan, as required.

Input Service Distributor under GST

The concept of Input Service Distributor (ISD) is provided in GST too. It is defined as ‘an office of supplier of goods and/or services, which has received input services under the cover of tax invoice, and is allowed to distribute the said tax credit to the supplier of goods and/or services registered under the same PAN’. This indicates that the ISD is an office:

- Which can be a head office, administrative office, corporate office, regional office, depot, and so on, belonging to registered taxable person who intends to distribute the credit

- Which receives tax invoices towards the receipt of inward supply of services

- Which distributes the tax credit paid of inward supplies of services to the branch units which have consumed the services, and issues invoices for the distribution of credit

Registration under GST

An ISD is required to obtain a separate registration. The registration is mandatory and there is no threshold limit for registration for an ISD. Businesses who are already registered as an ISD under the existing regime (i.e. under Service Tax), will be required obtain a new ISD registration under GST. This is because, the existing ISD registration will not be migrated to the GST regime.

Manner of Distribution

Under GST, on an intrastate transaction, CGST and SGST will be applicable. In case of transaction within a union territory, CGST and UTGST will be applicable. IGST will be applicable in case of interstate transactions and imports. The following are the scenarios of distribution of credit by an ISD:

- ISD and the recipient of credit are located in the same state

- ISD and the recipient of credit are located in different states

The unit to which the input tax credit is distributed is referred to as the ‘recipient of credit’.

ISD and recipient of credit are located in the same state

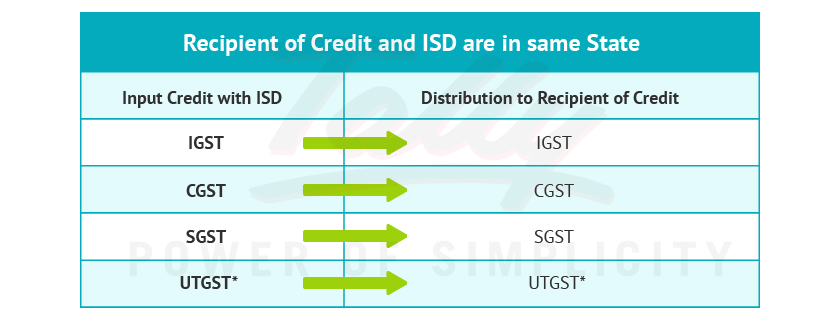

When the ISD and recipient of credit are located in the same state/union territory, the input tax credit of IGST, CGST, SGST, and UTGST should be distributed to the recipient in the following manner:

*Applicable on transactions within a union territory

Let us understand with an example.

Top-In-Town Home Appliances Ltd, is located in Bangalore, Karnataka. They also have units located in Mysore, Chennai and Mumbai. The unit in Bangalore is the Head Office and registered as an ISD. They do bulk procurement of common services which are used by the other units too.

Top-In-Town Home Appliances Ltd (HO) receives an invoice of Rs.1,00,000 with GST of Rs.18,000 (CGST Rs.9,000 + SGST Rs.9,000) towards advertisement services provided exclusively to the Mysore unit.

The credit will be distributed as CGST Rs.9,000 and SGST Rs.9,000.

Recipient of credit and ISD are located in different states

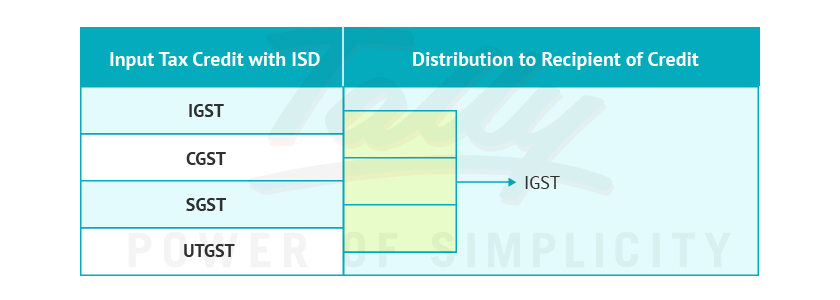

When the ISD and the recipient of credit are located in different states/union territory, the input tax credit of IGST, CGST, SGST, and UTGST should be distributed to the recipient of credit in the following manner:

For example, Top-In-Town Home Appliances Ltd (HO) receives an invoice of Rs.1,00,000 with a GST of Rs.18,000 (CGST 9,000 + SGST 9,000) towards advertisement services provided exclusively to the Chennai unit.

The credit of CGST Rs. 9,000 and SGST Rs. 9,000 will be distributed to the Chennai unit as IGST, Rs. 18,000.

Return Forms under GST

| Return Type | Frequency | Due Date | Details to be furnished |

|---|---|---|---|

| Form GSTR-6A | Monthly | 0n 11th of succeeding month | Details of inward supplies made available to the ISD recipient on the basis of FORM GSTR-1 furnished by the supplier |

| Form GSTR-6 | Monthly | 13th of succeeding month | Furnish the details of the input credit distributed |

The concept of ISD in GST is similar to the provisions existing under CENVAT credit rules and Service Tax. In this blog we have discussed about the fundamentals of an ISD in GST. Watch out for our next blog to know how to distribute the credit to the recipient of credit.

Latest Blogs

Nuts & Bolts of Tally Filesystem: RangeTree

A Comprehensive Guide to UDYAM Payment Rules

UDYAM MSME Registration: Financial Boon for Small Businesses

Understanding UDYAM Registration: A Comprehensive Guide

MSME Payment Rule Changes from 1st April 2024: A Quick Guide

Are Your Suppliers Registered Under MSME (UDYAM)?