E-Invoicing in GST

e-Invoicing is a critical aspect of GST. Invoicing practices have been quite an industry-specific. Despite the proprietary ways of preparing invoices, unified approach of e-invoicing was taken in good spirit by the overall taxpayers. Since it is a relatively new concept, there are a lot of unanswered questions and apprehensions around this new statutory change. Thus, here we give you a thorough understanding of e-invoicing as a concept, how it will impact businesses, what is the eligibility to generate an e-invoice and how TallyPrime’s integration with the IRP portal, eases the generation of e-invoice without altering your current invoicing process.

E-way Bill

E-way bill or Electronic-way bill is a document introduced under the GST regime that needs to be generated before transporting or shipping goods worth more than INR 50,000 within state or inter-state. Rolled out nationwide on 1st April 2018, e-way bill came in with a whole set of questions in the minds of a business owner. In this section, we have tried to answer your questions on the several rules imposed by the government while generating an e-way bill, who is exempted from filing an e-way bill, state-wise e-way bill treatments and how Tally helps you generate an e-way bill, seamlessly.

GST Return

Under GST, there are various GST return forms, which taxpayers can use to file GST returns online. All these forms are required to be e-filed as per the GST return filing process laid down in the GST return rules section of the GST Act. Each of the GSTR form have a different purpose and applicability, based on which businesses are expected to file their returns. With so many returns as regulatory, it could be quite confusing to understand which return you need to file and when, as a business owner. Thus, we have compiled a list of the GST return forms for your understanding, just so you can always stay tax compliant. Here are the details of these GST return formats, along with details of applicability, periodicity, their importance and relevance.

GST Council Meeting and Updates

GST Council is an apex member committee to modify, reconcile or to procure any law or regulation based on the context of goods and services tax in India. The council is headed by the union finance minister Nirmala Sitharaman assisted with the finance minister of all the states of India. The GST council is the key decision-making body that will take all important decisions regarding the GST. The GST Council dictates tax rate, tax exemption, the due date of forms, tax laws, and tax deadlines, keeping in mind special rates and provisions for some states. The predominant responsibility of the GST Council is to ensure to have one uniform tax rate for goods and services across the nation. In this section, we give you a wholesome view of all the latest GST council meeting updates, announcements and key decisions taken by the governing body.

GST Invoice

The introduction of e-invoice was approved by GST council at its 37th meeting held in the month of September,2019 with the key objective to ensure inter-operability of e-invoices across the GST eco-system. Invoice being a key document and e-invoicing being a reform related to it, it is super important for businesses to understand it fully and accordingly prepare towards to it. In this section, you will get a deep understanding of e-invoicing and its importance for business owners. With several benefits attached to this mechanism, e-invoicing is a revolution in itself. Though it aims as helping businesses become more tax compliant, e-invoicing still raised a lot of questions in the users’ minds. So, do you still have some e-invoicing questions unanswered? Give this section a read, and get your answers clarified!

GST Registration

Rolled out nationwide on July 1, 2017, GST In India follows a dual model where both the State and the Central government levy tax on goods and services. In the GST Regime, businesses whose turnover exceed Rs. 40 lakhs (Rs 10 lakhs for NE and hill states) are required to register as a normal taxable person. This process of registration is called GST registration. For certain businesses, registration under GST is mandatory. If the organization carries on business without registering under GST, it will be an offence under GST and heavy penalties will apply. Find out details and information on its eligibility, its process, required documents and much more.

GST Rates & Codes

Ever since GST or Goods and Services Tax regime was announced, there has been a wide speculation about the GST rates bracket. It’s clear that the government’s intentions are to have lower tax rate for goods and services which are essential needs and higher tax rates for goods and services that are considered as luxury supplies. Confused about which tax slab do your products/services fall under? Check out a curated a list of GST rates structure for various goods and services, classified across the different GST tax slabs.

Input tax Credit

A significant change that GST introduced was the mechanism of input credit under GST. ITC is the heart and soul of GST. Input Credit Mechanism is available to you when you are covered under the GST Act. Which means if you are a manufacturer, supplier, agent, e-commerce operator, aggregator or any of the persons mentioned here, registered under GST, you are eligible to claim input credit for tax paid by you on your purchases. In this section, we will give you a thorough understanding of ITC as a mechanism; including its calculation, eligibility and the treatment of exceptional scenarios in which ITC has already been availed.

Composition Scheme

Composition Scheme under GST is a relief mechanism, especially for small taxpayers, wherein they can not only have comparatively less tedious compliance practices to deal with, but also pay GST at a lower, fixed composition tax rate on their turnover. In this section, you will get a complete view of the GST composition scheme. From its eligibility, to its applicability, to some frequently asked questions, get all your queries cleared at a single click, right here.

GST Payment & Refunds

Staying tax compliant and updated with all the statutory changes imposed by the government is one of the topmost priorities of any business. However, in a rut of running a business in the smoothest way possible, often the GST return filing dates get missed out on. Now, with a law as stringent as GST in our nation, this non-compliance will impact your business in a huge way. Just so you do not miss out on the latest GST reforms announced by the government, we have curated a detailed section on the GST payments, penalties for non-compliance, late fees, refund process and rules for you.

Time, Place & Value of Supply

Under GST, the existing system of levy of tax on manufacture, provision of taxable services, and sale of goods will be replaced by the concept of ‘Supply’. Thus, it is of extreme importance, to understand the “place of supply” meaning in determining the right charge of tax on supply. When a supply involves movement of goods, the place of supply is the location at which the movement of goods terminates for delivery to the recipient. So, what exactly is bill of supply, what is its format, what is place of supply of services under GST, these and many such commonly asked questions will get answered in this section.

Impact of GST

GST has simplified the taxation system of the country. As GST is a single tax, calculating taxes at the multiple stages of the supply chain has become easier. Through this, both customers and manufacturers get a clear idea of the amount of tax they are charged and its basis. Further, hassles of handling tax officials and authorities can also be avoided. With ‘One Nation, One Tax’ in picture, GST has helped remove the cascading effect of multiple taxes. While the government’s aim was to simplify lives of the business owners, GST as a tax norm has impacted several sectors in different ways. While you may have a clear understanding of GST’s impact in your industry/segment, here’s a thorough study on how it impacted most primary industries that play a huge part in boosting the Indian economy.

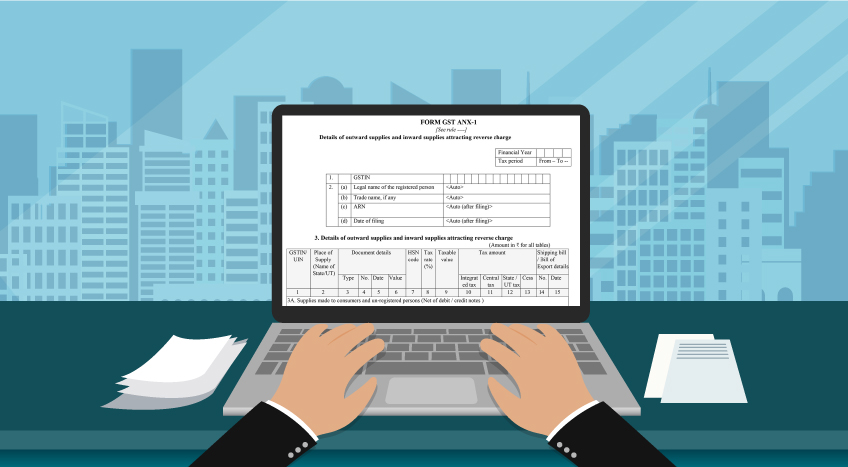

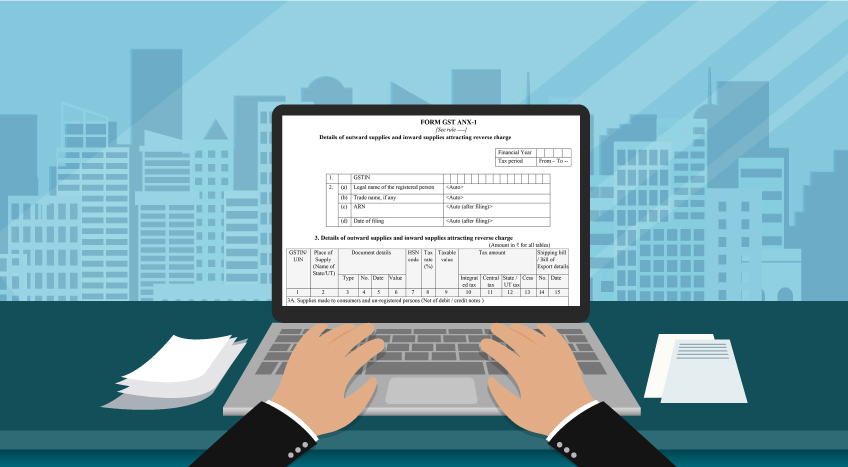

New GST Returns

The new GST return system will contain simplified return forms, for ease of filing across taxpayers registered under GST with one main return GST RET-1 and 2 annexures GST ANX-1 and GST ANX-2. This return will need to be filed on a monthly basis, except for small taxpayers who can opt to file the same quarterly. Find new gst rules, new gst return types, check current vs. new GST returns & more.

GST Fundamentals

GST or Goods and Service Tax was introduced by the Government to simplify India’s taxation system. With CGST, SGST and IGST in place, there are many changes expected from the implementation of GST across the country. Whether it makes goods cheaper for the common man like you and me, nobody can tell. But this is going to impact our lives in our jobs, our businesses and the overall economic environment. Understand the basics of GST and learn about who it applies to.