Tally Solutions |Updated on: April 25, 2023

With the advent of GST on 1st July, 2017, an immediate task on your hands is to generate accurate invoices that meet the criteria laid down for GST tax invoices. An important component of a GST tax invoice is the tax collected on the supply.

To calculate the correct value of tax to be collected on a supply, determining the GST rate applicable to the goods or services supplied is important. It is equally important to determine the correct value, on which tax at the prescribed rate is to be levied. If this is not done, it can result in unnecessary litigation, levy of interest, and the recipient could even lose input credit on the supply.

This is a guide for you to determine the correct value on which tax is to be levied on a supply. This value on which GST is to be levied, is called the transaction value.

Steps for calculating the value on which GST is to be charged in an invoice

1. Determine the price of the goods or service supplied

2. Add any additional charges, such as commission, packing

3. Add any other tax applicable on the supply, other than GST

4. Deduct discount shown in the invoice

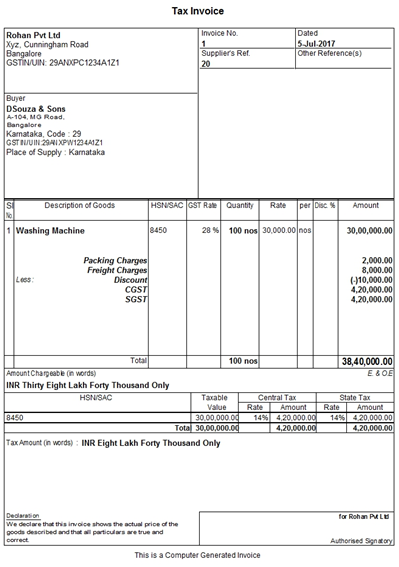

Example: Rohan Pvt Ltd in Karnataka supplies 100 washing machines to a dealer, Dsouza & Sons, in Karnataka. The price of 1 washing machine is Rs. 30,000. Rohan Pvt Ltd charges Rs. 2,000 for packing of the washing machines and Rs. 8,000 for freight. A discount of Rs. 10,000 is given to Dsouza & Sons. The GST rate applicable to washing machines is 28%.

Let us arrive at the value on which GST is to be charged in this supply.

| Particulars | Quantity | Rate | Amount |

|---|---|---|---|

| Washing machines | 100 | 30,000 | 30,00,000 |

| Add: Packing charges | 2,000 | ||

| Add: Freight charges | 8000 | ||

| Less:discount | (-)10,000 | ||

| Taxable value | 30,00,000 | ||

| CGST @14% | 4,20,000 | ||

| SGST @ 14% | 4,20,000 | ||

| Total invoice value | 38,40,000 |

The invoice for this will appear as shown below:

How to treat additional charges or discounts incurred after the supply

Additions to value

- Additional charges

- Any amount payable by you (supplier) but incurred by the recipient, such as transportation

- Interest/late fee/penalty charged on the recipient for delayed payment

In these cases, a debit note should be raised, linked to the original invoice and GST should be charged on the value.

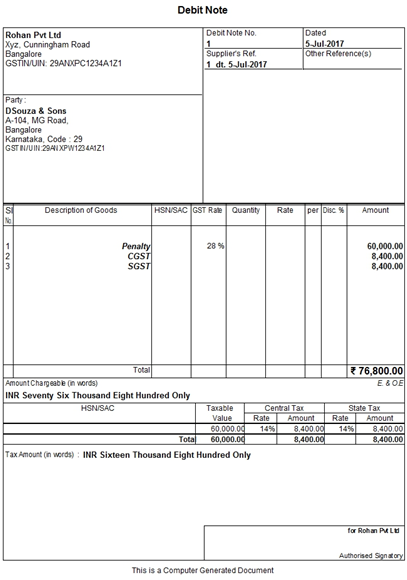

Example: On the supply in the above example, Rohan Pvt Ltd charges penalty of Rs. 60,000 as Dsouza & Sons fails to make payment within the agreed period of 30 days.

Here, Rohan Pvt Ltd should raise a debit note against the above invoice, charging GST @ 28% (Rate applicable to washing machines) with calculation as shown below:

| Particulars | Amount |

|---|---|

| Penalty charged for delayed payment | 60,000 |

| CGST @ 14% | 8400 |

| SGST @ 14% | 8400 |

| Total debit note value | 76,800 |

The debit note will appear as shown below

Deductions from the value

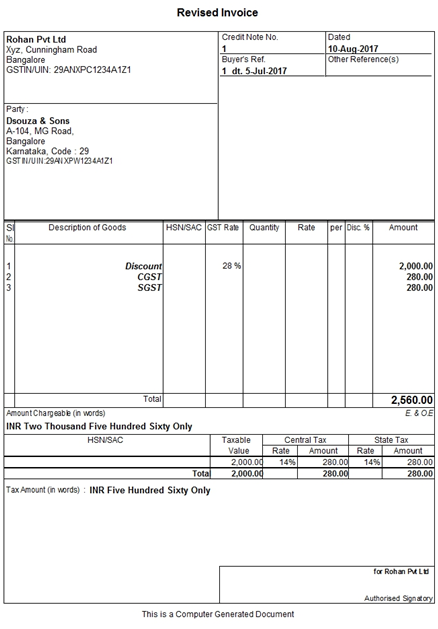

• Discount given after the supply. If discount is given after the supply, ensure that it is agreed upon before the supply and can be linked to a specific invoice. Such a discount can be deducted from the transaction value. For this, raise a credit note for the discount amount and the applicable GST.

Example: As per the agreement of Rohan Pvt Ltd and Dsouza & Sons, if Dsouza & Sons make payment for the supply by online banking, Rohan Pvt Ltd will offer a discount of Rs. 2,000 on the invoice value. Accordingly, Mr. Dsouza makes payment by online banking. For the discount of Rs. 2,000 given, Mr. Rohan should raise a credit note against the original invoice with particulars as shown below:

| Particulars | Amount |

|---|---|

| Discount | 2000 |

| CGST @ 14% | 280 |

| SGST @ 14% | 280 |

| Total credit note value | 2560 |

The credit note will appear as shown below:

Latest Blogs

How to Easily Shift/Migrate Your Data to TallyPrime

Nuts & Bolts of Tally Filesystem: RangeTree

A Comprehensive Guide to UDYAM Payment Rules

UDYAM MSME Registration: Financial Boon for Small Businesses

Understanding UDYAM Registration: A Comprehensive Guide

MSME Payment Rule Changes from 1st April 2024: A Quick Guide