Yarab A |Updated on: May 14, 2021

In the Bill to - Ship to model, the billing and shipping of goods are done to two states and entities. In order to avoid the cascading of multiple taxes through the course of the transaction, the first sale will be taxable, and any subsequent sale during the movement of goods is exempt from tax. Today, Bill to - Ship to transactions are a common occurrence.

Let us understand 'Bill to - Ship to' transactions with an example.

Ganesh Traders, a dealer in hardware goods, located in Maharashtra receives an order from Maruthi Traders, located in Karnataka. The order is for the supply of 100 aluminium ladders, with an instruction to ship the ladders to Prime Hardwares, located in Tamil Nadu. Prime Hardwares is a customer of Maruthi Traders.

There are two parts to this transaction:

- First part of the transaction - between Ganesh Traders and Maruthi Traders: Ganesh Traders is the supplier of ladders and Maruthi Traders is the buyer. Accordingly, Ganesh Traders bills the transaction to Maruthi Traders, and as per the instruction, ships the goods to Prime Hardwares in Tamil Nadu.

- Second part of the transaction - between Maruthi Traders and Prime Hardwares: Maruthi Traders is the supplier and Prime Hardwares is the buyer. Maruthi Traders bills the transaction to Prime Hardwares, and endorses the lorry receipt (goods shipped in a lorry by Ganesh Traders) in favour of Prime Hardwares. This lorry receipt (LR) will enable Prime Hardwares to take the delivery of the goods.

Before we proceed to understand Bill to-Ship to transaction in GST, we will understand how these transactions are taxed under the current regime.

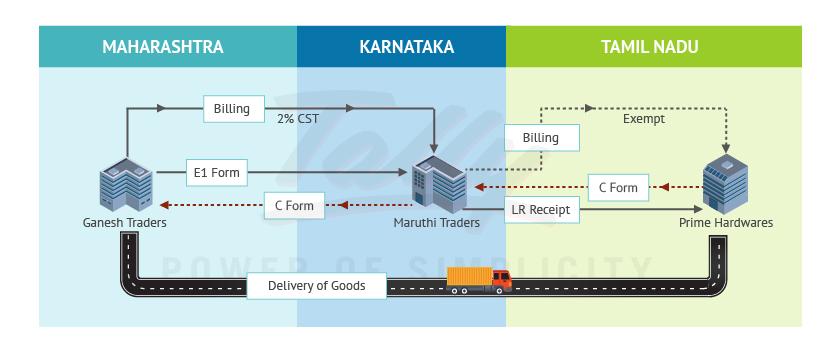

VAT regime: how Bill to - Ship to transactions are taxed

In Bill to -Ship to transactions, there is a first sale and a subsequent sale. In the current regime, tax should be levied on both parts of the transaction - on the first sale by Ganesh Traders to Maruthi Traders, and the subsequent sale by Maruthi Traders to Prime Hardwares.

However, in order to avoid tax being calculated multiple times through the course of the transaction, exemptions are provided on subsequent sales. These exemptions however, are subject to the furnishing of the prescribed forms. To get the exemption on the subsequent sale, a declaration Form E1 has to be issued by the first seller, and C-Form has to be issued by the buyer for levy of CST at a reduced rate of 2%.

Let us understand this with an illustration.

In the above illustration, Ganesh Traders bills to Maruthi Traders, and ships the goods to Prime Hardwares. Ganesh Traders issues Form E1 to Maruthi Traders, and the C form is produced by Maruthi Traders for availing CST @ 2%. Subsequently, Maruthi Traders bills to Prime Hardwares against C Form without charging tax, and endorses the Lorry Receipt in favour of Prime Hardwares.

Treatment of bill to - ship to transactions under GST

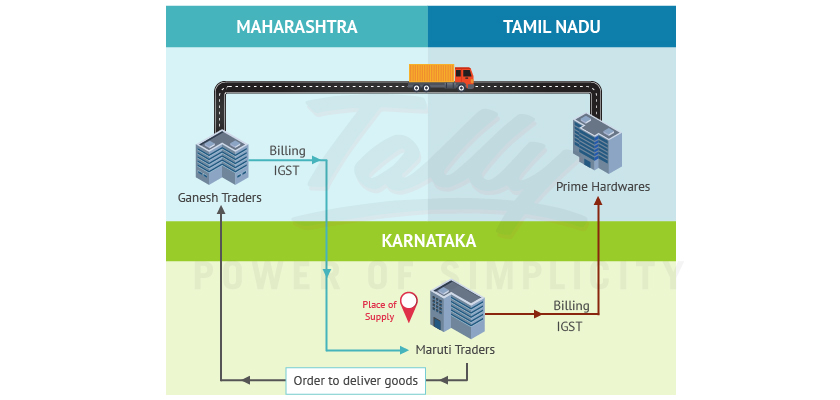

Under GST, the place of supply of goods is very critical to determine the transaction as interstate or intrastate. Accordingly, the applicable taxes can be levied.

In GST, if the goods are supplied by the supplier to the recipient on the direction of a third person, it will be deemed that the third person has received the goods, and the place of supply will be the principal place of business of such third person. Let us understand this with an example.

Ganesh Traders is a dealer in hardware goods, located in Maharashtra. They receive an order from Maruthi Traders, located in Karnataka, to supply 100 aluminium ladders, with an instruction to ship the ladders to Prime Hardwares, located in Tamil Nadu.

In the example, on the instruction from Maruthi Traders, Ganesh Traders ships the aluminium ladders to Prime Hardwares located in Tamil Nadu. Here, Maruthi Traders is deemed as the third person. Therefore, the place of supply will be the principal place of business of the third person i.e., Karnataka. Accordingly, Ganesh Traders charges IGST on billing to Maruthi Traders. The second part of transaction between Maruthi Traders and Prime Hardwares will also be interstate, and IGST will be charged.

Let us discuss further with various scenarios.

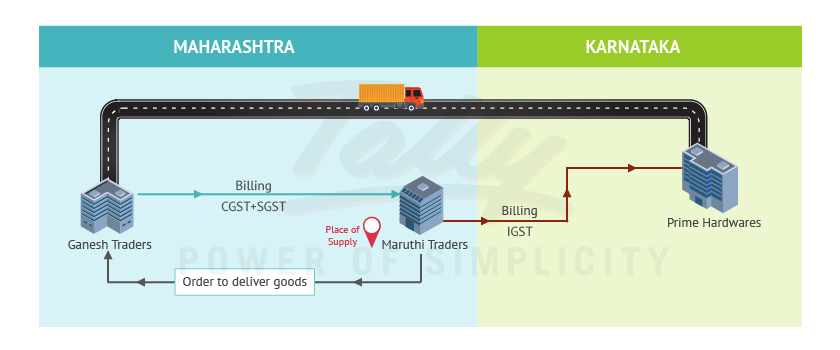

Scenario 1

| Particulars | Supplier | Third Party | Recipient | Place of Supply | Type of Transactions |

|---|---|---|---|---|---|

| State | Maharashtra | Maharashtra | Karnataka | Maharashtra | Intra-state |

| Party Name | Ganesh Traders | Maruthi Traders | Prime Hardwares |

In the example, on the instruction from Maruthi Traders, Ganesh Traders ships the aluminium ladders to Prime Hardwares located in Karnataka. Here, Maruthi Traders is deemed as the third person. Therefore, the place of supply will be the principal place of business of the third person i.e., Maharashtra. Accordingly, Ganesh Traders charges CGST+ SGST on billing to Maruthi Traders. The second part of transaction between Maruthi Traders and Prime Hardwares will be interstate, and IGST will be charged.

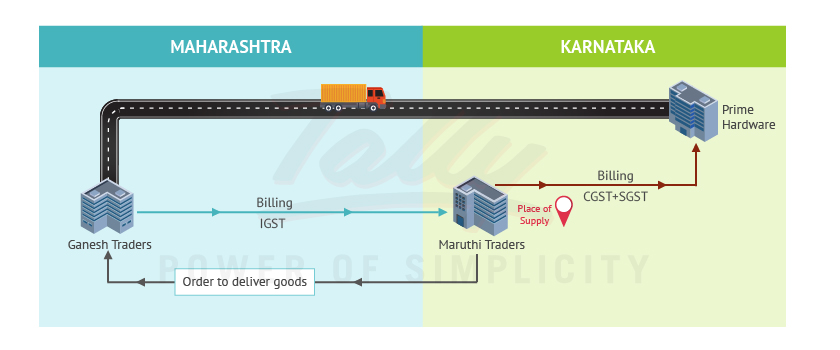

Scenario 2

| Particulars | Supplier | Third Party | Recipient | Place of Supply | Type of Transaction |

|---|---|---|---|---|---|

| State | Maharashtra | Karnataka | Karnataka | Karnataka | Interstate |

| Party Name | Ganesh Traders | Maruthi Traders | Prime Hardwares |

The principal place of business of the third party in the above scenario is Karnataka, and the place of supply will be Karnataka. This is an interstate transaction, and is liable for IGST. The second part of the transaction between Maruthi Traders and Prime Hardwares will be intrastate, and CGST+SGST will be charged.

Latest Blogs

How to Easily Shift/Migrate Your Data to TallyPrime

Nuts & Bolts of Tally Filesystem: RangeTree

A Comprehensive Guide to UDYAM Payment Rules

UDYAM MSME Registration: Financial Boon for Small Businesses

Understanding UDYAM Registration: A Comprehensive Guide

MSME Payment Rule Changes from 1st April 2024: A Quick Guide