Pramit Pratim Ghosh |Updated on: June 26, 2023

- What is a GSTIN or GST number?

- What is the importance of GSTIN?

- GST Number Format

- How to apply for GST number?

- What is the fees applicable to register under GST?

- Conclusion

What is a GSTIN or GST number?

The important identifier for businesses in the GST era is the GSTIN or Goods and Services Tax Identification Number, or simply GST number. Most businesses on applying for GST number or migrating their registration under the previous indirect tax regime would have first received a 15 digit provisional GSTIN, followed by confirmation of the same, once all the relevant documents have been verified.

There can be multiple GSTIN for a single person, being an assessee under the Income Tax Act for every State or Union Territory in which such person operates from. It becomes compulsory to obtain GSTIN when the person crosses the threshold limit for GST registration by registering himself under GST.

Unlike the previous indirect tax regime, where multiple registration numbers were present for different laws like Excise, Service Tax and VAT, it is a single registration number under GST- GSTIN.

How to get a GST number, is thus a natural query for businesses, who are keen to apply for GST number in the new indirect taxation regime.

What is the importance of GSTIN?

Under GST, knowing one’s GST number India is extremely important for any business – as the suppliers of the business need to quote the GSTIN correctly as the GST invoice serial number in all the invoices which are supplied, which will lead to the right allocation of input tax credit. Similarly, businesses should also get GST number from their customers, and include that in invoices issues to them, as the customers’ input tax credit will be dependent on this. In short, all businesses should apply for GST number India, as GSTIN is an important requirement for any business. This will help businesses to not only avail the right input tax credit, but also to uphold its credibility in the market. Businesses should be thorough about how to get GST number and most importantly how to apply for GST number in India.

GST Number Format

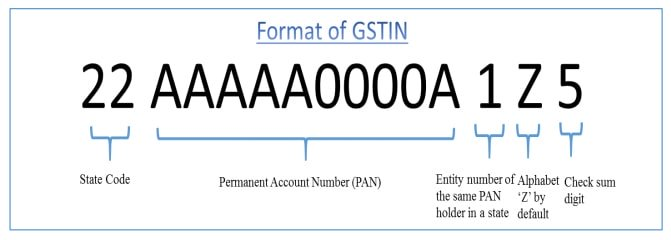

As discussed above, the GSTIN is a 15 digit identification number. The following are the details of each digit, which constitutes the GSTIN format:

- 1st 2 digits: This is the state code as per the Indian Census 2011, as given below:

|

State code list |

State |

State code list |

State |

|

01 |

Jammu & Kashmir |

19 |

West Bengal |

|

02 |

Himachal Pradesh |

20 |

Jharkhand |

|

03 |

Punjab |

21 |

Orissa |

|

04 |

Chandigarh |

22 |

Chhattisgarh |

|

05 |

Uttarakhand |

23 |

Madhya Pradesh |

|

06 |

Haryana |

24 |

Gujarat |

|

07 |

Delhi |

25 |

Daman & Diu |

|

08 |

Rajasthan |

26 |

Dadra & Nagar Haveli |

|

09 |

Uttar Pradesh |

27 |

Maharashtra |

|

10 |

Bihar |

28 |

Andhra Pradesh (Old) |

|

11 |

Sikkim |

29 |

Karnataka |

|

12 |

Arunachal Pradesh |

30 |

Goa |

|

13 |

Nagaland |

31 |

Lakshadweep |

|

14 |

Manipur |

32 |

Kerala |

|

15 |

Mizoram |

33 |

Tamil Nadu |

|

16 |

Tripura |

34 |

Puducherry |

|

17 |

Meghalaya |

35 |

Andaman & Nicobar Islands |

|

18 |

Assam |

36 |

Telengana |

|

37 |

Andhra Pradesh (New) |

- Next 10 digits:This is the PAN of the business entity.

- 13th digit: This denotes the serial number of registrations the business entity has for business verticals in the state, under the same PAN. It can range from 1-9 for businesses with up to 9 business vertical registrations in the state and for more than 9 registrations, from A-Z. For example, when a business entity gets a GST no. for its 3rd business vertical in the state, this digit will be 3, whereas when a business entity gets GST registration no. for its 13th business vertical in the state, this digit will be D.

- 14th digit:This will be ‘Z’ by default.

- 15th digit: This digit denotes a ‘checksum’

How to apply for GST number?

In order to obtain GST registration number India, one has to either migrate the registration under the previous indirect tax regime into the GST era, or needs to apply for a new registration. While the process is seamless due to its online nature, one needs to ensure that the requisite form i.e. GST REG-01 is filled with the correct information, and the business owner has the correct documents by his side, in order to complete this process in time. Any business which has a query about how to get GST registration number can visit the GST portal to know the detailed process.

The procedure to get GST number is as follows:

- Log in to gst.gov.in

- As part of the GST REG-01 form, fill out the following pages:

- Business Details

- Promoter / Partners

- Authorized Signatory

- Authorized Representative

- Principal Place of Business

- Additional Places of Business

- Goods and Services

- Bank Accounts

- State Specific Information

- Verification

- Once you have submitted your GST REG-01 form, you will receive an e-mail and SMS, notifying you that your new registration application has been submitted. This notification will contain the 15 digit Application Reference Number (ARN).

- Once the Application Form is submitted, it is subject to mandatory verification in the GST portal, based on which it could get approved or rejected. Also, in certain cases, there might be certain fields for which some more explanation or further documents might be additionally required from your side

- In case, some more clarification is required from you, a Show Cause Notice (SCN) Reference No. will be provided using which you need to log into the portal, navigate to the exact page and field where the clarification is needed, and use the same to upload the relevant documents.

- Once your New Registration Application has been verified and approved in the GST portal, you will receive a 15 digit GSTIN (Goods and Services Tax Identification Number) along with a temporary password. You can start logging in by using the GSTIN number as the User ID and the temporary password which you can reset after the first log in.

What is the fees applicable to register under GST?

Businesses can register for GST and obtain GST registration number free of cost.

Conclusion

In conclusion, how to take GST number is an important point for businesses across the country. Further details on how to get GST no. is available at www.gst.gov.in.

Know More about GST Registration

GST Registration, GST Registration Eligibility, GST Registration Certificate, Documents Required for GST Registration, How to Check GST Registration Status

GST

GST Software, GST Calculator, GST on Freight, GST Exempted Goods & Services, Reverse Charge Mechanism in GST, GST Declaration

GST Rates & Charges

GST Rates, GST Rate Finder, HSN Codes, SAC Codes, GST State Codes

GST Returns

GST Returns, Types of GST Returns, New GST Returns & Forms, Sahaj GST Returns, Sugam GST Returns

Latest Blogs

How to Easily Shift/Migrate Your Data to TallyPrime

Nuts & Bolts of Tally Filesystem: RangeTree

A Comprehensive Guide to UDYAM Payment Rules

UDYAM MSME Registration: Financial Boon for Small Businesses

Understanding UDYAM Registration: A Comprehensive Guide

MSME Payment Rule Changes from 1st April 2024: A Quick Guide