Pramit Pratim Ghosh |Updated on: April 25, 2023

There are many scenarios, where a tax payer may want to reject e-way bill generated against his GSTIN, by other parties – be it recipient, supplier or transporter. The reasons could either be an e-way bill raised by mistake or as a recipient, you may not have got the consignment as per the details mentioned in the e-way bill. In such a case, the right option to adapt for you would be to reject e-way bills. Also, it is important for you to track e-way bills, so that you are clear about the various e-way bills you are involved in.

How to reject E-way Bills

In order to use this option, you need to follow the steps given below:

- Be ready with the e-way bill number which you want to reject, and also be aware of the date on which that was raised

- Log on to ewaybill.nic.in

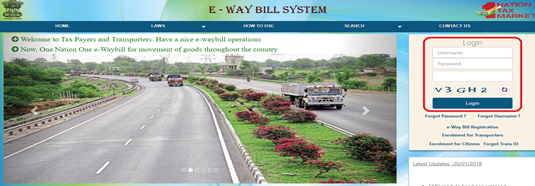

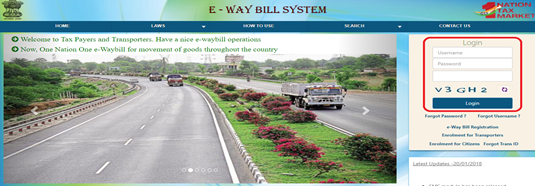

- Enter your User Name and Password, then the Captcha Code, and then click “Login”, as shown in the picture below:

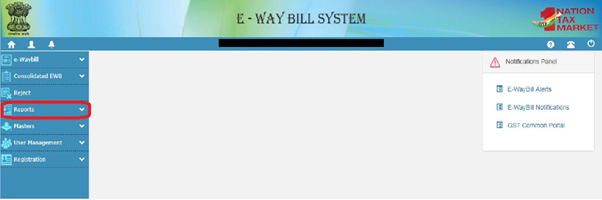

- On successful authentication of your credentials, the main menu of the e-way bill portal will open up. On the left hand side, click the option “Reject”, as shown below:

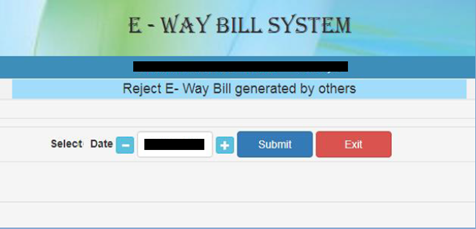

- On doing so, the following screen is shown:

- Select the date on which the concerned e-way bill was raised, and feed that into the “Select Date” field

- Click “Submit”

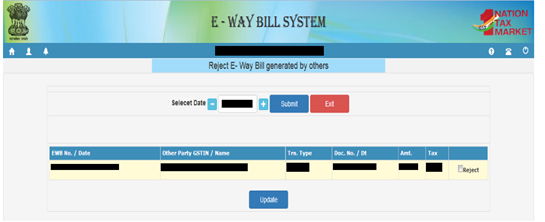

- On doing so, the system will show all the e-way bills generated on that particular date. Select the concerned e-way Bill and reject it by checking the check box on the right side, which you will see on the right hand side of all the listed e-way bills, as shown below:

However, the process of e-way bill rejecting is time-bound. As a recipient, one can communicate the acceptance or rejection of consignments as specified in the e-way bill. If the acceptance or rejection is not communicated within 72 hours from the time of generation of e-way bill, it will be deemed that he has accepted the details, and the option for rejecting e-way bill will no longer be available.

How to track E-way Bills

Now, that we have gone through the various methods to generate, modify, cancel and reject e-way bills, it obviously becomes important for any business to do e-way bill tracking. In short, some kind of a report needs to be there, which should be a one-stop guidance to the business owner or decision maker in the business, about the various e-way bill actions, which have taken place.

In order to generate various reports pertaining to the e-way bill, i.e. for tracking e-way bills, you may follow the steps given below:

- Log on to ewaybill.nic.in

- Enter your User Name and Password, then the Captcha Code, and then click “Login”, as shown in the picture below:

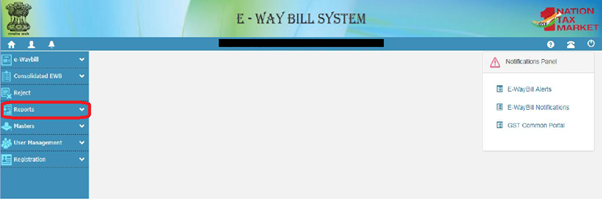

- On successful authentication of your credentials, the main menu of the e-way bill portal will open up. On the left hand side, click the option “Reports”, as shown below:

- On doing so, the following screen will emerge, which will give you the option to generate reports based on the various masters i.e. clients, suppliers, transporters and products:

- You will be able to generate the following reports using this facility, as shown below:

-

- EWB generated by me – This will give you a list of e-way bills generated by you for a particular date. This will include details of rejected EWBs, cancelled EWBs and verified EWBs

- EWB generated by others - This will give you a list of e-way bills generated by others against your GSTIN for a particular date

- Outward Supplies - This will generate the list of e-way bills which have been shown as outward supplies from you for a particular date

- Inward Supplies - This will generate the list of e-way bills which have been shown as inward supplies to you for a particular date

- Masters – This generates the list of master entries under the different categories i.e. clients, suppliers, transporters and products

Latest Blogs

Nuts & Bolts of Tally Filesystem: RangeTree

A Comprehensive Guide to UDYAM Payment Rules

UDYAM MSME Registration: Financial Boon for Small Businesses

Understanding UDYAM Registration: A Comprehensive Guide

MSME Payment Rule Changes from 1st April 2024: A Quick Guide

Are Your Suppliers Registered Under MSME (UDYAM)?