Tally Solutions |Updated on: June 28, 2022

In our previous blogs , we have discussed in detail the liability of tax on transportation services availed from a GTA. Based on the type of person availing the service, the liability of tax falls upon the service receiver or the GTA. In addition to transportation services taken from a GTA, there can also be a case where the supplier of goods transports the goods to the recipient and levies transportation charges in the invoice. In such a case, let us understand how the transportation charges levied by the supplier is treated under GST.

In this regard, the areas to be discussed are:

1. Is there a tax liability on the transportation charges levied in the invoice? If so, who is liable to pay tax on this: is it the supplier or the recipient?

2. What is the rate of GST applicable to the transportation charges levied?

3. Can input tax credit be availed on tax paid on transportation charges?

Let us answer these questions:

1. Tax liability on transportation charges levied in invoice

The tax liability on transportation charges levied by a supplier of goods can be understood from the table below:

| Type of supplier | Type of recipient | Is there a Tax liability? | Who is liable to pay the tax? |

| Registered | Registered | Yes | Supplier |

| Registered | Unregistered | Yes | Supplier |

| Unregistered | Registered | Yes, if the total value of supplies from unregistered persons made by the recipient exceeds Rs. 5,000 in a day | Recipient |

| Unregistered | Unregistered | No tax liability | ----- |

2. Rate of GST applicable on transportation charges in invoice

The transportation charges levied by the supplier of goods have to be included in the transaction value and GST is to be levied on the total transaction value. In case multiple goods are being supplied on which different GST rates are applicable, the transportation charges have to be appropriated to each item, based on quantity or value, and on the resulting transaction value for each item, the applicable GST rate is to be charged.

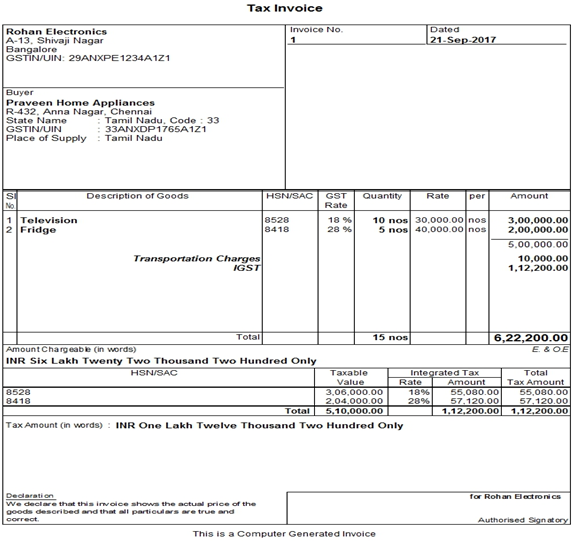

Example: Rohan Electronics, registered in Karnataka, supplies 10 televisions for value of Rs 30,000 each and 5 fridges for value of Rs. 40,000 each to a registered dealer, Praveen Home appliances, in Tamil Nadu. Rohan Electronics also transports the goods and charges Rs. 10,000 as transportation charges.

In this case, the rate of GST applicable to television is 18% and to fridge is 28% and transportation charges are levied on the entire consignment. Hence, the transportation charges need to be appropriated to each of the items, based on quantity or value. Let us appropriate the transportation charges of Rs. 10,000 to the items based on value.

The transportation charges appropriated to Televisions will be 3,00,000 (Value of televisions)/5,00,000 (Total value of the items)*10,000 (Transportation charges), which is Rs. 6,000. Similarly, the transportation charges appropriated to Fridge will be 2,00,000/5,00,000*10,000, which is Rs. 4,000.

Accordingly, IGST should be charged as shown below:

| IGST @18% on transaction value of televisions (value of televisions + transportation charges appropriated to televisions, i.e. 3,00,000 + 6,000) | 55,080 |

| IGST @28% on transaction value of fridges (value of fridges + transportation charges appropriated to fridges, i.e. 2,00,000 + 4,000) | 57,120 |

The invoice for this will appear as shown below:

3. Input tax credit of tax paid on transportation charges in invoice

Full input tax credit can be availed on the tax paid on transportation charges levied by the supplier of goods.

Latest Blogs

Nuts & Bolts of Tally Filesystem: RangeTree

A Comprehensive Guide to UDYAM Payment Rules

UDYAM MSME Registration: Financial Boon for Small Businesses

Understanding UDYAM Registration: A Comprehensive Guide

MSME Payment Rule Changes from 1st April 2024: A Quick Guide

Are Your Suppliers Registered Under MSME (UDYAM)?