Yarab A |Updated on: June 28, 2022

The new GST returns proposed to be introduced on 1st October,2020, aims to drastically reduce the complexities attached to GST compliance in the current day. In order to allow businesses to get used to new returns, a trail functionality has been enabled on the GST common portal.

The prototype of new GST returns will enable the businesses to experience and learn the new functionality before it goes live. Before you get your hands into the prototype of new GST returns, it is recommended to know a few key aspects of new GST returns.

Here are the key highlights of all-new simplified GST return which will come into effect from 1st April, 2020.

Classification of taxpayers

Under the new GST return framework, the taxpayers are classified into small Taxpayers and large taxpayers. Small taxpayers are those having annual turnover up to 5Cr in previous financial year and taxpayers having a turnover of more than 5 Cr in a previous financial year are treated as large taxpayers.

This change will widen the small taxpayer’s bracket eligible for quarterly returns from the existing threshold of 1.5 Cr. The increased threshold will ensure that around 90% of businesses will benefit the simpler compliance under the new GST return framework.

Single GST return

Single GST return is introduced with the concept of outward annexure (Form GST ANX-1) and inward annexure (Form GST ANX-II). In outward annexure, the businesses are required to admit the liability by furnishing the outward supplies and inward supplies attracting reverse charge. In-turn, these details will be auto-populated into your main return.

On the other hand, inward annexure will capture the details of purchases for claiming the input tax credit. This annexure will be auto-populated based on the invoices uploaded by your supplier. Like Form GST Anx-1, these details too will be auto-populated into main GST return.

The new GST return framework will significantly reduce the efforts and time required for filing returns as most of the details required are auto-populated into the main returns.

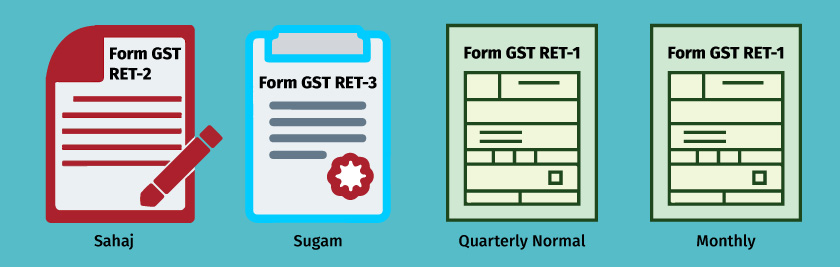

Different types of new GST returns

Based on the size the businesses, the type of supplies, customers you deal and the geography, the GST council has designed different type of GST Returns. Sahaj, Sugam and quarterly normal returns are the quarterly return available for small taxpayers. Monthly return (Form GST RET-1) for larger taxpayers. To know more, read ‘New GST Returns Forms’

The returns are so simple that it requires only fewer details basis the business profile and the compliance requirements in relation to ITC are very minimum. It is expected that the cost of compliance will be less.

Profile-based returns format

Instead of having a common GST return format for all, the council has designed different type of GST returns considering the diversity of business operations. This comes with the option to personalize the return format based on the supplies you make.

As a result, only the relevant information will be shown based on the business profile. For example, a small manufacturer or trader, buying and selling locally may need to file a return consisting of only fewer information.

Continuous upload of invoice

The new GST return is provisioned for continuous uploading of invoices by the supplier anytime during the month. At the end of the filing period, these invoices will be auto-populated in the return.

By just uploading the Invoices, most of your work-related return filing is done and at the end of the return period, it becomes so simple that you can validate with your tax expert and file the return.

Viewing facility of invoices

Based on the invoices uploaded by your supplier, the real-time viewing facility of invoices is made available to the buyer. This achieved by auto-populating the details of the invoices uploaded by the supplier into the inward supplies’ annexure known as Form GST ANX-II. This also comes with an option for looking of invoice.

This will help you to verify and lock the invoice to confirm the eligible ITC. Locking of invoice will ensure that invoices uploaded by your supplier is correct and the invoice will be locked for further modification by the supplier. Thus, the risk of ITC loss in a certain business situation is mitigated.

Amendment of returns and invoice

The concept of revised returns to be introduced and you will be allowed to revise return for any tax period. Returns will be revised either by filing amendment returns or reporting of missing invoice. Provision to revise the current returns (GSTR-1 and GSTR-3B) is not available.

Also, amendment (editing) of invoice by the supplier is provisioned in the new GST return framework. The supplier can edit only if the invoice has not been locked by the recipient. If it is already locked, unless it is reset/unlocked by the recipient, the details cannot be edited by the supplier.

No automatic reversal of ITC

No automatic reversal of input tax credit at the recipient’s end in the case of default in the payment of tax by the supplier. In such situations, recovery efforts will be first made from the supplier.

ITC on missing invoice

Invoices or debit notes which have not been uploaded by the supplier, the recipient is allowed to avail input tax credit (ITC) on a provisional basis in the same month and a window of 2 tax period are allowed to report such missing invoice.

The facility of availing ITC and reporting is allowed for Larger taxpayers (Monthly returns) and small taxpayers filing RET-1 (quarterly normal return). In other words, businesses who have opted Sahaj return and Sugam return will not be allowed avail ITC on the missing invoice.

Want to know more about the different types of new GST Returns and business profile each return supports? Read our article 'New GST Return'

Latest Blogs

A Comprehensive Guide to UDYAM Payment Rules

UDYAM MSME Registration: Financial Boon for Small Businesses

Understanding UDYAM Registration: A Comprehensive Guide

MSME Payment Rule Changes from 1st April 2024: A Quick Guide

Are Your Suppliers Registered Under MSME (UDYAM)?

Nuts & Bolts of Tally Filesystem: Embedded Indexing