Yarab A |Updated on: November 25, 2022

DSC stands for Digital Signature Certificate. Digital Signature Certificates (DSC) can be used to sign documents digitally. In India, DSC is issued by authorized certifying authorities. You can obtain a DSC from one of the authorized DSC-issuing certifying authorities, post which DSC Registration needs to be done at the portal. Note that the GST portal accepts only PAN based Class II and III DSC.

DSC Registration for user authentication is mandatory for companies and Limited Liability Partnerships (LLP). All other registered persons can also use DSC to authenticate a user. Let us now understand how to register DSC in GST portal:

DSC registration process in GST portal

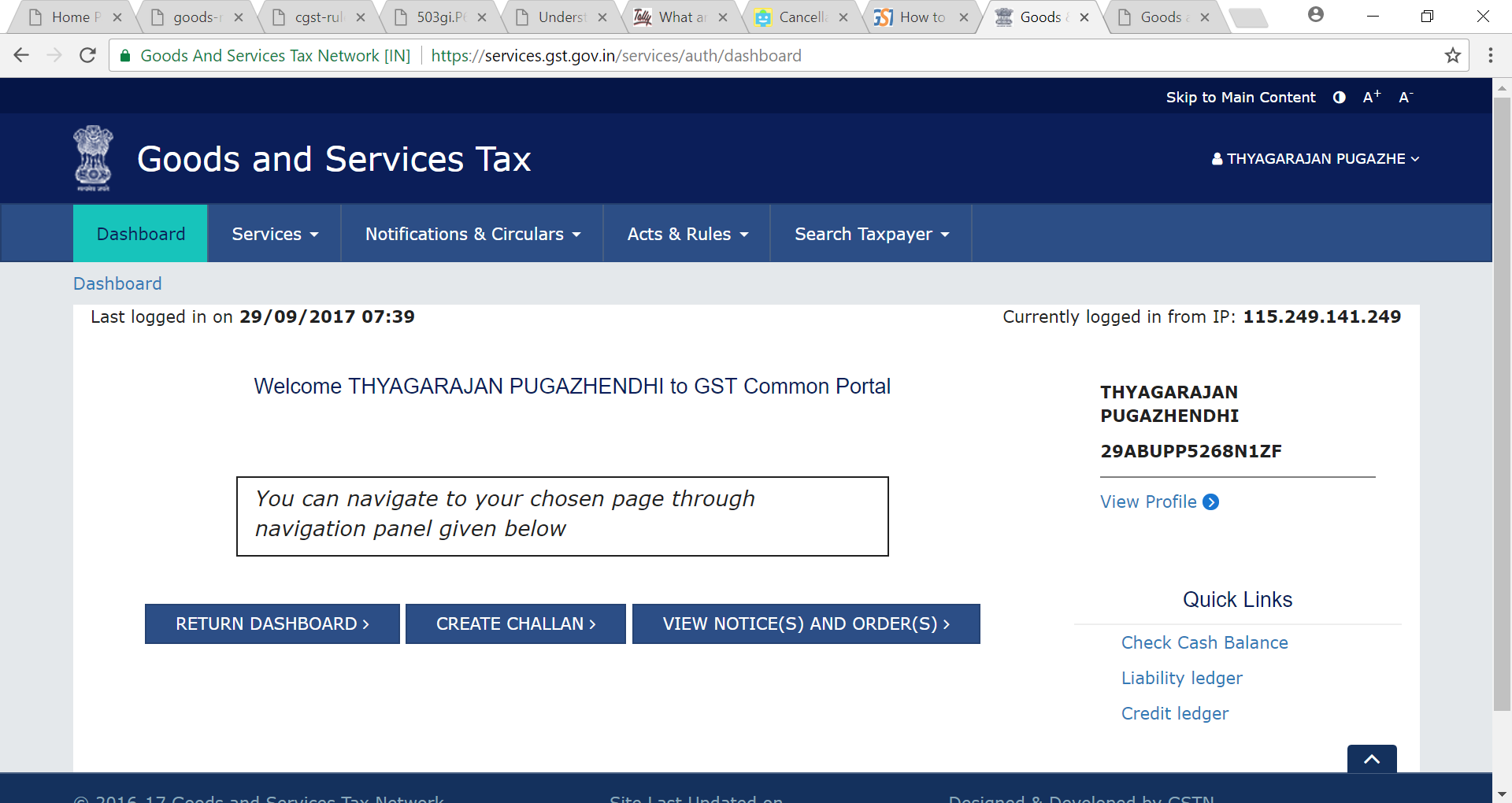

- Login to the GST portal.

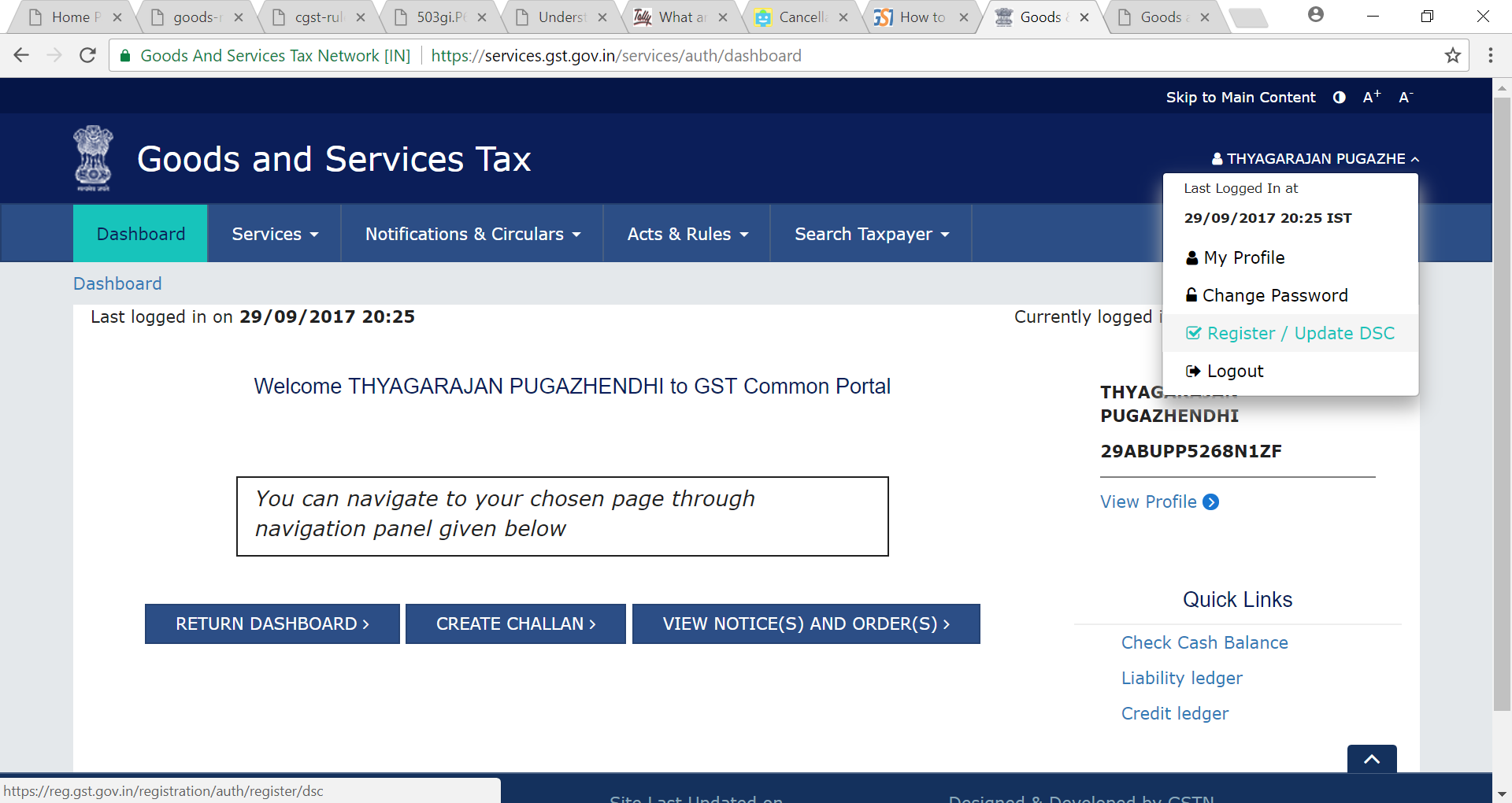

- Click on your user name on the top right section.

- Click Register/Update DSC

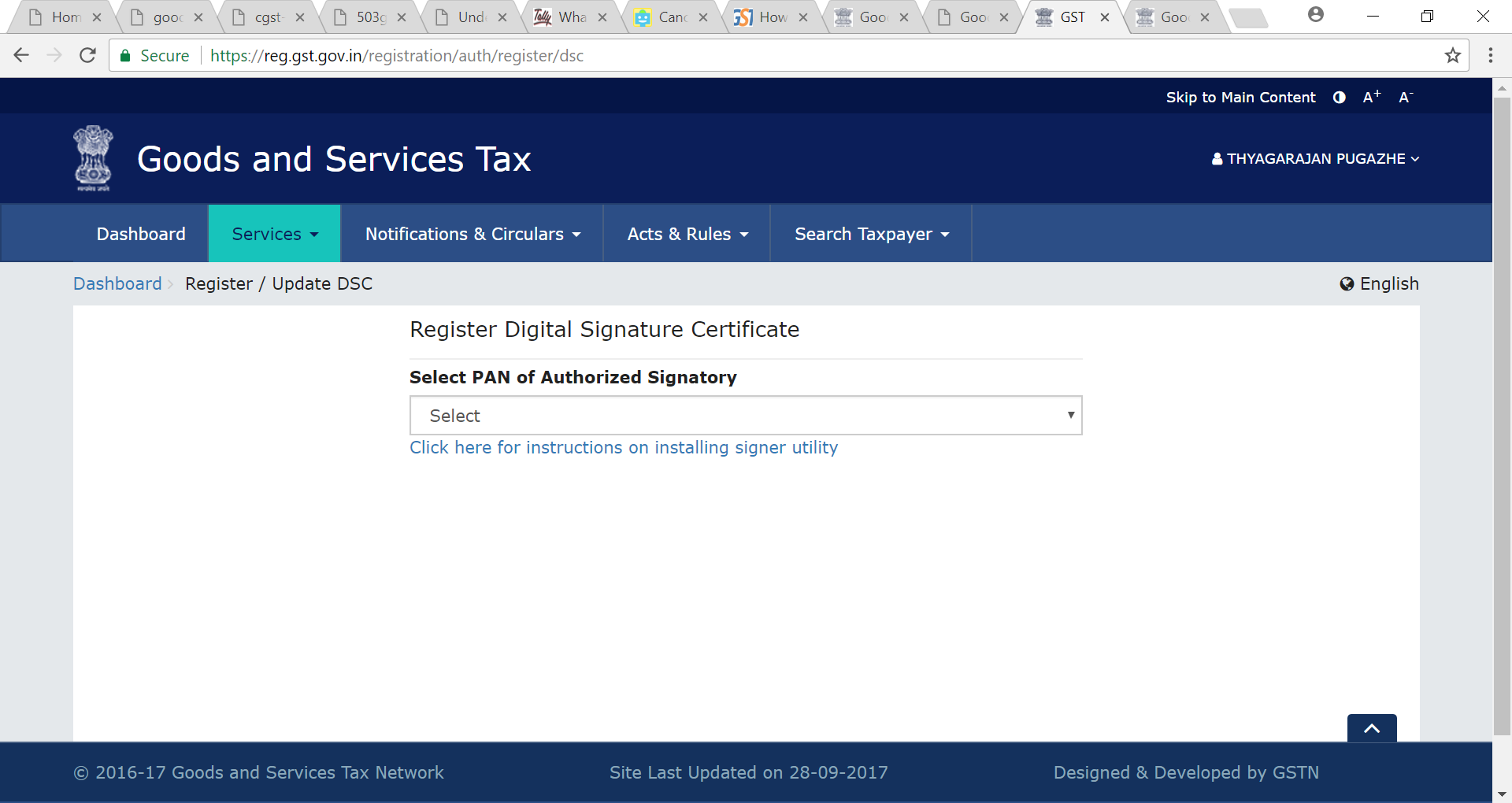

- Attach your DSC dongle and open emSigner utility. In case you have not downloaded the emSigner utility, click ‘Click here for instructions on installing signer utility’.

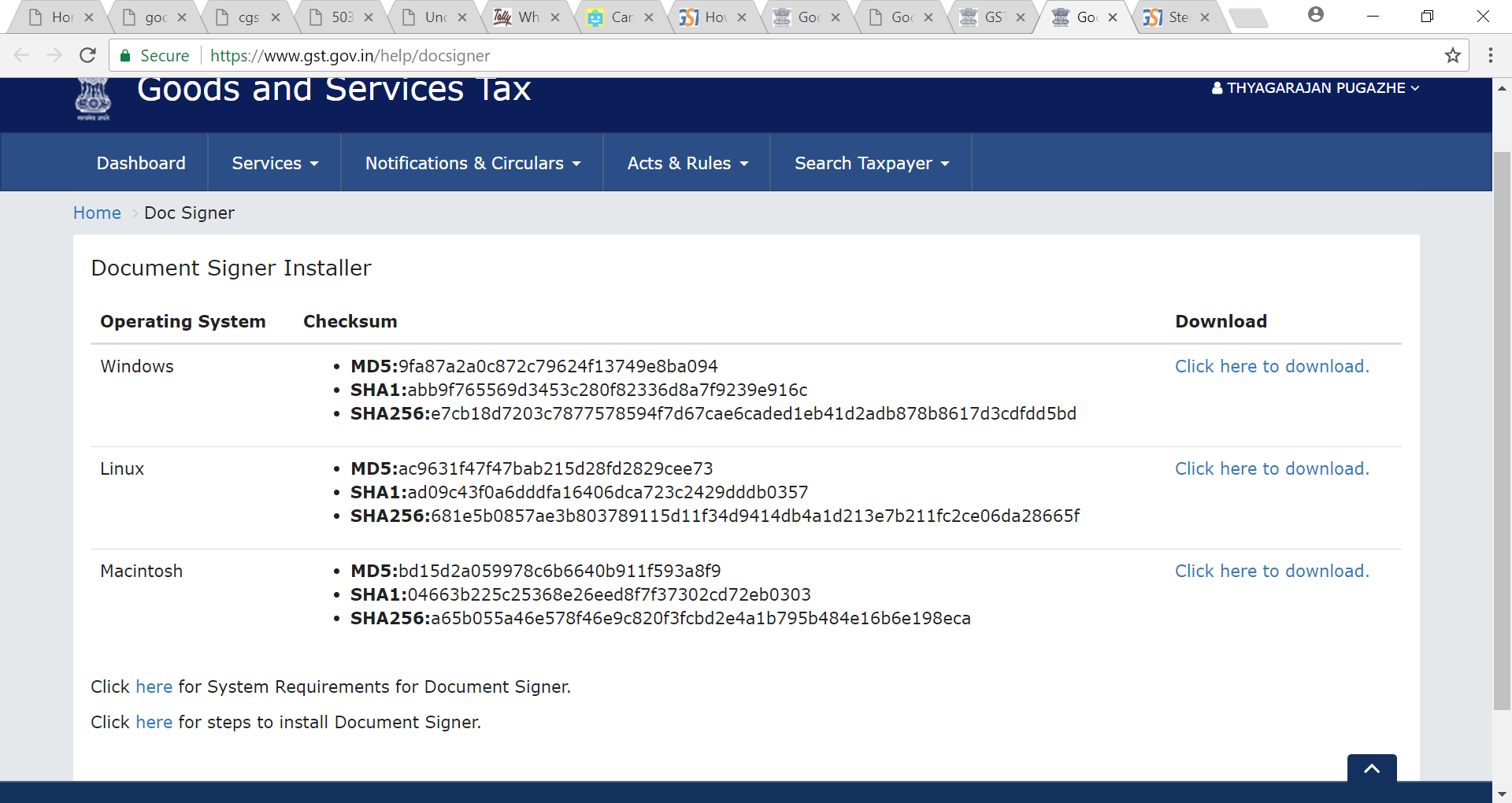

- A new page opens, from where you can download the utility, based on the Operating System you are using.

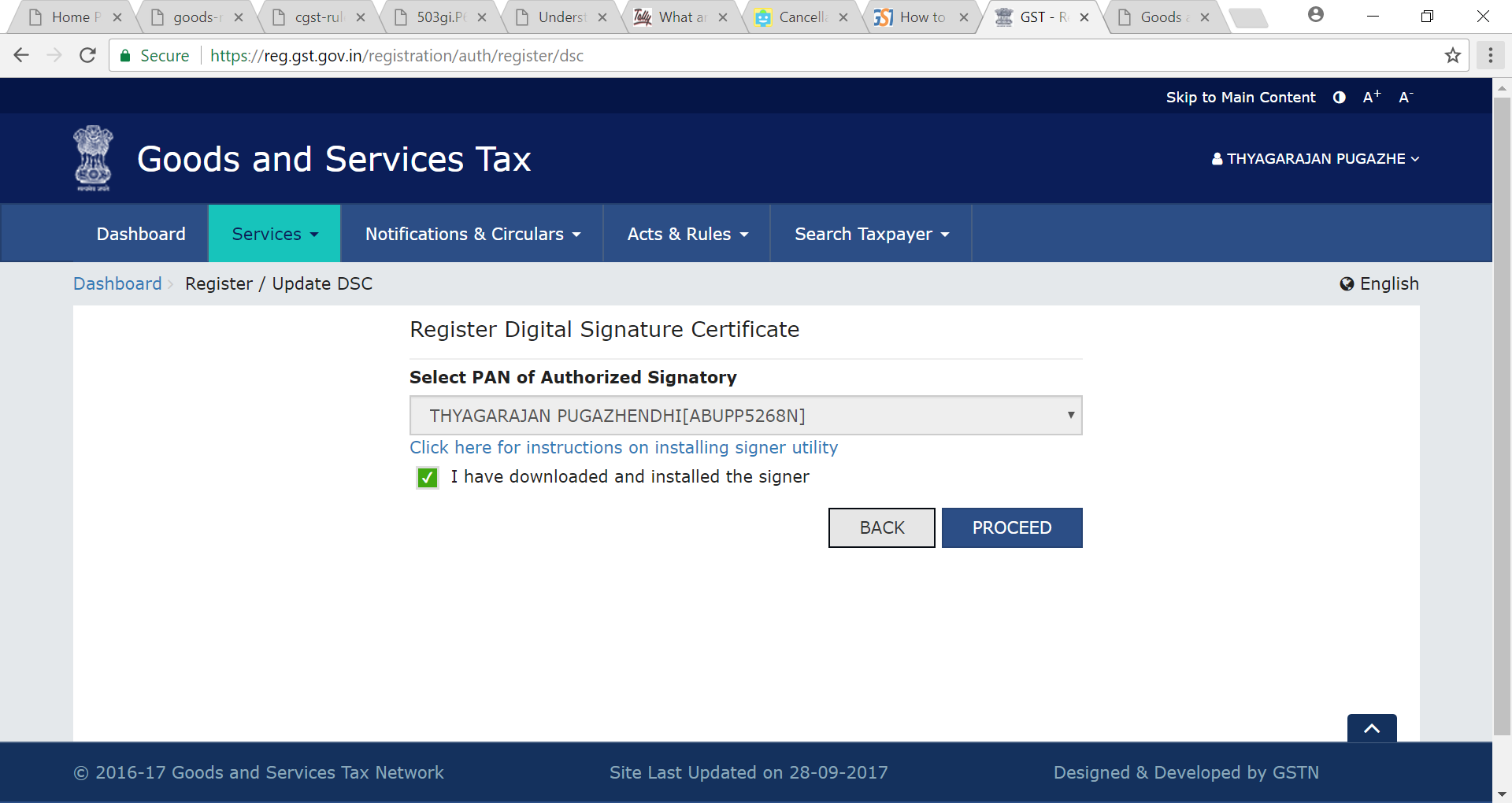

- The Register/Update DSC page will show a dropdown with the PAN of all the authorized signatories. Select your PAN from the dropdown.

- Click the checkbox to confirm that you have download and installed the emSigner utility. Click Proceed.

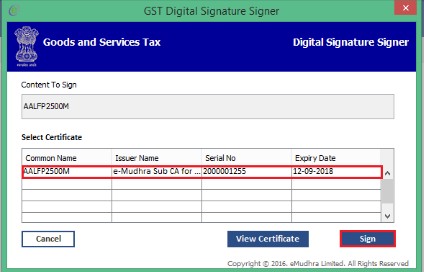

- Select the certificate and click the Sign

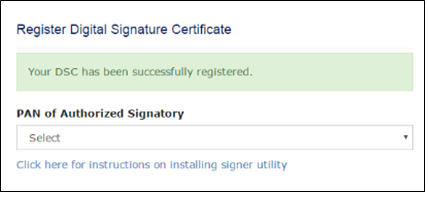

- A message ‘Your DSC has been successfully registered’ is displayed.

Read more

Latest Blogs

Nuts & Bolts of Tally Filesystem: RangeTree

A Comprehensive Guide to UDYAM Payment Rules

UDYAM MSME Registration: Financial Boon for Small Businesses

Understanding UDYAM Registration: A Comprehensive Guide

MSME Payment Rule Changes from 1st April 2024: A Quick Guide

Are Your Suppliers Registered Under MSME (UDYAM)?