Tally Solutions |Updated on: April 11, 2023

This article has been updated as per the GST Council's decision to suspend reverse charge mechanism on purchase of goods or services from unregistered dealers.

Reverse charge is a concept we were familiar with, in the previous tax regime. To put it simply, under reverse charge, the liability to pay tax on a transaction to the Government is on the recipient. Under Service Tax, reverse charge was applicable in the case of specific notified services. Under VAT, in almost every state, on purchases from unregistered dealers, a registered person had to pay tax, on behalf of the unregistered seller. It was also applicable in the case of imports, where the importer had to pay import duties to the Government.

Under GST also, reverse charge is applicable in these 3 scenarios:

- Supply of notified goods and services

- Imports

- Purchase from unregistered dealers

Supply of notified goods and services

Certain goods and services have been notified, on receiving which, the recipient has to pay tax to the Government. These notified goods are cashew nut in shell, bidi wrapper leaves, and tobacco leaves. The services on which tax is to be paid by the recipient on reverse charge is available here.

Imports

When you import goods and/or services, you will have to pay tax to the Government on the import, as per the rate applicable to the goods and/or services. On the value of the goods or services imported, customs duty will be levied separately, as it is not subsumed under GST. On the basic price + customs duty, IGST will be levied.

Purchase from unregistered dealers

When you purchase taxable goods and/or services from unregistered dealers, you will have to pay tax to the Government on the supply. This will be at the rate applicable to the goods and/or services. Note that this reverse charge is not applicable if the aggregate value of purchases from unregistered dealers does not exceed Rs. 5,000 in a day.

Note: Reverse charge mechanism on purchases from unregistered dealers has been suspended by the GST Council. A decision on it's applicability will be taken by the GST Council on a later date.

How to raise invoice for supplies on which tax is to be paid on reverse charge?

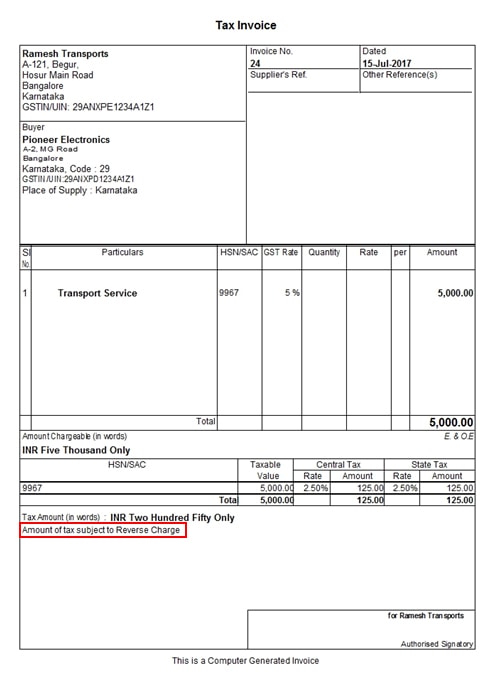

You can raise an invoice for supplies on which tax is to be paid on reverse charge, as shown below:

How to furnish details of supplies on which tax is to be paid on reverse charge?

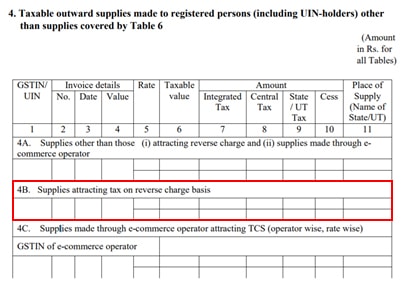

Details of outward supply of notified goods and/or services, on which tax is to be paid by the recipient on reverse charge basis, should be furnished in Form GSTR-1:

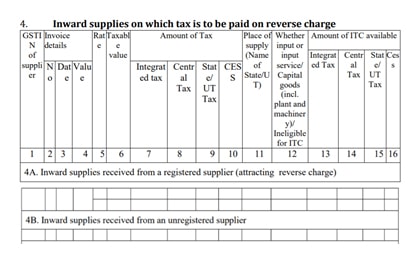

Details of inward supplies on which tax is to be paid by you on reverse charge basis should be furnished in Form GSTR-2:

Latest Blogs

Nuts & Bolts of Tally Filesystem: RangeTree

A Comprehensive Guide to UDYAM Payment Rules

UDYAM MSME Registration: Financial Boon for Small Businesses

Understanding UDYAM Registration: A Comprehensive Guide

MSME Payment Rule Changes from 1st April 2024: A Quick Guide

Are Your Suppliers Registered Under MSME (UDYAM)?